I like CNBC’s senior stock analyst Herb Greenberg. I generally count on him for his solid and thorough research. But last week, he wandered off into an anecdotal wilderness. So this is to Herb, in honor of Labor Day.

Dear Herb,

I watched some of your CNBC “coverage” on unemployment insurance, where you implied that people would rather collect unemployment insurance than work. I do believe there are some people who go through the motions of a job search just to collect unemployment insurance. There is even evidence to suggest that unemployment insurance can delay workforce participation. But in this economy, your broad-brush proposition bordered on the absurd.

Had you researched this half as well as you research stocks, you might have realized that countries like Germany have much more generous unemployment benefits, yet much higher labor participations rates, than we do right now. Or maybe you would have reviewed the latest Help Wanted Index from The Conference Board and realized that a dearth of labor supply was hardly the issue.

Or maybe you would have investigated the studies that concluded workers were more willing to rejoin the workforce only after their unemployment benefits ran out — just as carefully as you investigate a company’s balance sheet. Some of them studied time periods when labor markets were tight and the penalty for delaying a job search was minimal. But we don’t have a tight labor market today. Few people assume they can just go out and get a job tomorrow.

Other studies looked at time periods following a recession. In past recessions, jobs lagged but eventually rebounded during a recovery. It’s possible that some would-be workers waited until benefits ran out before taking up the search for employment in earnest. Maybe they were lazy. Or maybe they knew the search would be easier in a recovering job market. But maybe they didn’t wait at all. UI benefit duration and the time it took for job creation may have been highly correlated in the past. Maybe more people worked after their UI benefits ran out because there were just a ton more jobs.

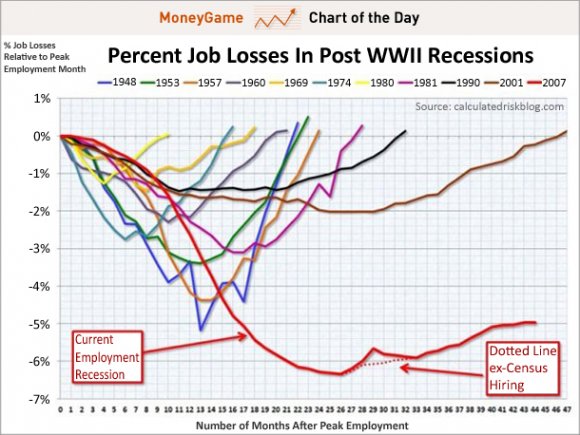

In past recessions, we have seen some spiking of job participation at the cessation of UI benefits. Are we seeing that now? Some new studies, like this working paper, suggest we are not seeing worker participation rise after UI benefits end — because there are no incremental jobs. This chart from CalculatedRisk probably says it best.

But you didn’t really study much for your piece. In fact you only provided limited anecdotal data. The basis of your “report?” was that a company told you that a couple of candidates canceled their interviews when their unemployment insurance benefits were extended. Did you ask the company how many people applied for those jobs? How many people never even got the courtesy of a rejection after submitting a resume and cover letter? Twenty? A hundred?

If anecdotes persuade you, I’ve got some. I have a friend that took a low-paying job out of state, just so he could get off unemployment and support his family from afar. He lives in a shared furnished apartment in Austin while he pays the mortgage on his house in Chicago. He has been separated from his family for more than a year.

I have another friend that took a job that barely covered her childcare costs. She still wonders if she was stupid to give up unemployment insurance to end up a net loser by working. But she was willing to do it to rid herself of the label of “unemployed.” She knew from the data, the longer she was unemployed the less likely companies would be to hire her. In this recession, there are much bigger disincentives for “waiting” to find a job. (There are also studies on that too, Herb, if you’re interested) But she made a tough choice — and one that some families can’t afford to make.

I know a few people who were laid off from IBM. IBM did offer some of them jobs in emerging markets — at roughly 35% of their salaries — and less than unemployment benefits. If they didn’t take those jobs, does that support your premise that unemployment insurance destroys the incentive to work? Or does it just illustrate how one company found a way not to pay US workers US wages. (IBM turned in record profits last quarter)

I know a guy who voluntarily terminated his unemployment insurance. He no longer felt he could consistently look for another tech sector job – discouraged by unresponsive employers and by their canceled interviews. After 20 years as a software developer, he works part-time as a car mechanic now. My neighbor had to pull his kid out of college. He was willing to take any job to prevent that from happening.

I recently attended a small engineering conference. Some of the attendees were unemployed, but bore the cost of attendance so they could network.

Before the recession, there were 24.1 million contractors, freelancers and consultants in the US. They didn’t’ qualify for unemployment insurance when they lost work. They would kill for a job.

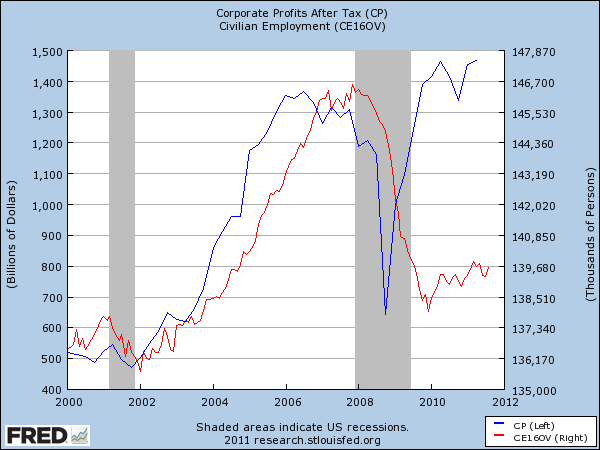

Stop drinking the Kool-Aid, Herb. Regulations and unemployment insurance benefit extensions are not hampering the economic recovery. Take a look at this chart from Business Insider. Tell me that the problem has anything to do with the inability of corporations to produce a profit or find workers. See that blue line? That’s corporate profits after taxes. See that red line? That’s civilian employment.

By the way, a lot of companies don’t believe regulations are a problem. Check out this small business survey. And companies don’t want to repatriate their offshore money. Their money is doing just fine where it is.

Tens of thousands of bank employees are scheduled to be laid off this year. How many would give up unemployment insurance for a chance to keep their jobs? My guess is every single one.

Our economic problem is demand. Consumers drive roughly 70% of the US economy. Unlike banks, they can’t borrow at near 0% interest rates – the average credit card rate is more than 14%. They have no home equity. And few corporations are hiring.

It’s not unemployment insurance, Herb. It’s unemployment.

Love,

Amy

P.S. If you’re concerned about filling jobs, why not promote CNBC’s five job openings? I bet if you gave that two minutes of air time or two tweets, CNBC would have more applications than it could handle. Or maybe it already does. At any rate, you can find them here.

P.S.S I’d also love to see a CNBC segment with Labor economists (not talking heads with opinions) on whether we are seeing more/less empirical evidence of employment spikes when UI benefits terminate in this recession.

By the way, here are some other current job listings I found this week:

The Wall Street Journal is looking for a senior editor for its new CFO Journal

If it’s entertainment you’re looking for, I can’t imagine a more perfect gig than Executive Assistant to StockTwits’ CEO. For all you San Dieagans who love the intersection of social media and investing, check it out.

I know you Austin web designers need work: I’ve read the barter section of craigslist. Spanning Backup – flush with $2million of new venture funding – has two openings right now.

3 Comments